If you’re a regular cruiser, owning shares in a cruise line can be a win–win. Not only could your investment grow in value, but you’ll also unlock shareholder perks every time you sail with that company.

The biggest perk? Free onboard credit, and it’s not a one-time deal. You can claim it every cruise, and in some cases, the benefit applies across multiple cruise lines under the same parent company.

I bought Carnival shares a while back and, just by cruising with Princess Cruises, I’ve already earned back what I paid, and I still own the shares. Of course, share prices can go up or down, but those onboard credit perks are yours to enjoy as long as you hold them.

In this guide, you’ll discover how owning cruise line shares can unlock free onboard credit, how to claim those perks, and where to buy shares if you want to start sailing with extra benefits.

Disclaimer

Just to be clear, nothing in this guide is financial advice. I’m not a qualified financial advisor, and if you choose to buy shares in any of the cruise lines mentioned, you should be aware that the value of your investment can go down as well as up.

My investments in shares are a personal choice, and I accept the risk that I could lose money. That said, I’ve already earned back what I paid in the form of onboard credit, but that’s my experience, not a guarantee.

Do Cruise Shares Get You a Discount?

Owning shares in a cruise line won’t knock money off your fare; you’ll still pay full price for your cabin. But in a way, you do get a discount on the overall cost of your trip. That’s because you’ll receive free onboard credit to put towards drinks, specialty dining, excursions, or whatever else takes your fancy while you’re at sea.

Cruise Lines That Offer Shareholder Perks

Some cruise lines reward loyal investors with free onboard credit every time you sail — as long as you meet the shareholding requirements. Here’s what you get with each company, starting with Royal Caribbean Group.

1. Royal Caribbean Group (RCL)

Own at least 100 shares in Royal Caribbean Group and you’ll qualify for shareholder perks on every cruise with:

- Royal Caribbean International

- Celebrity Cruises

- Silversea Cruises

Onboard credit amounts:

- $50 for sailings of 5 nights or less

- $100 for sailings of 6–13 nights

- $250 for sailings of 14+ nights

- $1,000 for world cruises

A couple of exceptions apply, no perks on chartered sailings or cruises to the Galápagos Islands.

For context, as of February 2026, Royal Caribbean Group shares are trading at around $348 each, meaning you’d currently need roughly $34,800 to buy the 100 shares required to unlock shareholder perks. Prices can change quickly, so always check the latest rate before making any investment.

2. Carnival Corporation (CCL or CUK)

Hold at least 100 shares in Carnival Corporation & PLC, and you’ll earn shareholder perks every time you cruise. The amount of onboard credit depends on the brand you’re sailing with and the ship’s onboard currency:

- $50 / €40 / £30 for sailings of 6 nights or less

- $100 / €75 / £60 for sailings of 7–13 nights

- $250 / €200 / £150 for sailings of 14+ nights

You can claim this perk when sailing with:

- Carnival Cruise Line

- Princess Cruises

- P&O Cruises

- P&O Australia

- Holland America Line

- Seabourn

- Cunard

- Costa Cruises

- AIDA Cruises

As of February 2026, Carnival Corporation shares are trading at approximately $32.81 each. That means you’d need about $3,281 to buy the 100 shares required to qualify for onboard perks. Remember, stock prices are always changing, so it’s essential to check the latest rate before investing.

Carnival has two stock listings: CCL (New York Stock Exchange) and CUK (London Stock Exchange). Both offer the same onboard credit benefits, so most investors simply buy whichever is cheaper at the time.

3. Norwegian Cruise Line Holdings (NCLH)

Own at least 100 shares in Norwegian Cruise Line Holdings and you’ll receive shareholder onboard credit every time you sail with any of their brands:

- $50 for sailings of 6 days or less

- $100 for sailings of 7–14 days

- $250 for sailings of 15+ days

You can claim this perk when cruising with:

- Norwegian Cruise Line

- Oceania Cruises

- Regent Seven Seas Cruises

As of February 2026, NCLH shares are trading at around $22.85 each. That means you’d need approximately $2,285 to purchase the 100 shares required to unlock shareholder perks. Stock prices fluctuate, so always check the latest rate before investing.

Shareholder Perks — At-a-Glance Table

| Cruise Company | Shares Required | Perk Amounts | Brands Included |

|---|---|---|---|

| Royal Caribbean Group | 100 | $50 (≤5 nights) / $100 (6–13 nights) / $250 (14+ nights) / $1,000 (world cruises) | Royal Caribbean, Celebrity Cruises, Silversea Cruises |

| Carnival Corporation | 100 | $50 / €40 / £30 (≤6 nights) / $100 / €75 / £60 (7–13 nights) / $250 / €200 / £150 (14+ nights) | Carnival, Princess, P&O, P&O Australia, Holland America, Seabourn, Cunard, Costa, AIDA |

| NCL Holdings | 100 | $50 (≤6 days) / $100 (7–14 days) / $250 (15+ days) | Norwegian Cruise Line, Oceania Cruises, Regent Seven Seas Cruises |

Where to Buy Cruise Stock

If you want to invest in cruise line shares, you’ll usually need to go through a stockbroker. This could be a traditional broker who can talk you through your options, or an online trading platform you can use yourself. Both charge fees, but online platforms are generally cheaper and quicker to set up.

I can’t recommend a specific broker, as I haven’t used them all, but popular online options include platforms like Interactive Brokers, Hargreaves Lansdown, eToro, and Fidelity. When choosing, compare fees, ease of use, and whether they give you access to the stock exchange your chosen cruise line is listed on, and always do your own research before making any decisions.

Once you’ve bought your shares, you’ll need to hold at least 100 shares in one of the qualifying cruise companies to get shareholder perks. Keep proof of your shareholding handy, as you’ll need to send it to the cruise line before each sailing to claim your onboard credit.

How to Claim Your Cruise Stock Perks

The process for claiming shareholder perks is slightly different for each cruise line, but it’s usually straightforward. You’ll need proof that you own at least 100 shares and details of your upcoming cruise booking.

Royal Caribbean Group

For Royal Caribbean International, Celebrity Cruises, and Silversea Cruises, claiming your onboard credit is easy:

Be sure to submit your claim at least three weeks before your sail date to give the process a smooth run.

Head over to the official Royal Caribbean shareholder benefit submission page and complete the form with your shareholding and cruise booking details: Submit your claim here.

For Silversea Cruises specifically, you can also use their survey-style request form: Fill out the Silversea Benefit Request.

Carnival Corporation

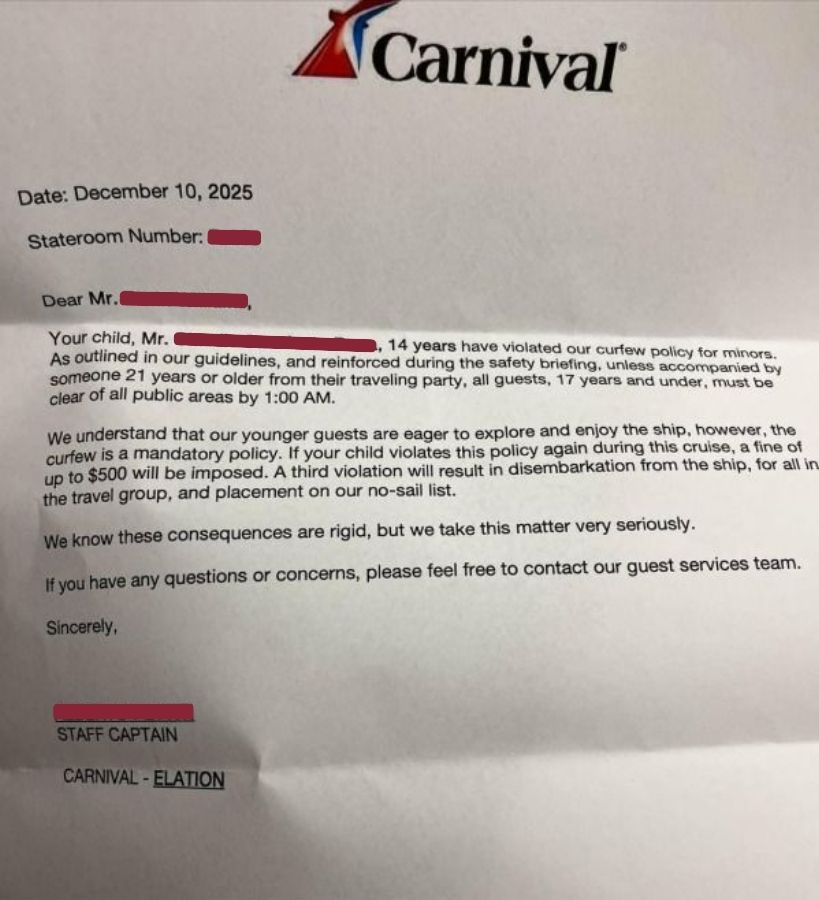

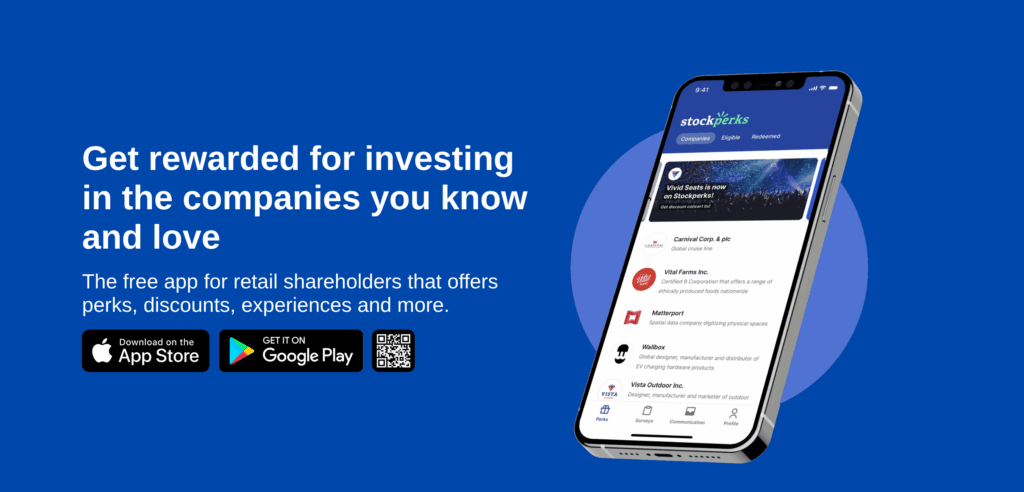

If you’re sailing with a Carnival Corporation brand, you’ll need to claim your shareholder perks through the Stockperks app (available for Android and iOS). Simply download the app, follow the step-by-step instructions, and upload proof of your shareholding along with your booking details.

Submit your claim at least three weeks before your cruise, but not too early. Carnival won’t process requests made more than a few months in advance, so if you try to claim too far ahead, you’ll receive an error message asking you to reapply closer to your sailing date.

Norwegian Cruise Line Holdings

To claim your onboard credit with Norwegian Cruise Line Holdings, download the shareholder benefit form, complete it, and email it to the relevant address for your cruise line:

- Norwegian Cruise Line: [email protected]

- Oceania Cruises: [email protected]

- Regent Seven Seas Cruises: [email protected]

Submit your claim at least 15 days before you sail, though it’s best to send it in as soon as your booking is confirmed to avoid any last-minute issues.

Final Word

Cruise line shares aren’t for everyone. Not everyone has the budget to buy the 100 shares needed to unlock perks, and there’s always some risk when investing. But if you do decide to take the plunge, the shareholder benefits can be a brilliant extra — especially if you sail with the same cruise line regularly.

The fact that you can claim onboard credit every single cruise makes it a perk that keeps on giving. So, if you’re already booking your next voyage, why not let your shares help pay for the cocktails, specialty dining, or spa days along the way?

Today’s Top Cruise Deals

See today’s best deals from ALL travel agents

You Might Also Like…

Thanks for reading!

I'm Kat, and I've been cruising for as long as I can remember — now I get to carry on the tradition with my own family!

If you enjoy my cruise tips, be sure to follow me on social media for more...