If you love to cruise and regularly use a credit card, the Carnival World Mastercard might be worth a look. Designed to reward your everyday spending with cruise-related perks, this card offers a points system that lets you save toward future sailings.

But there’s a big change on the horizon.

In June 2025, Carnival announced a major update: its long-standing VIFP loyalty programme will be replaced by Carnival Rewards, launching on 1st June 2026. With that change, the Carnival Mastercard will also transition from FunPoints to the new Carnival Rewards Points system.

This guide still tells you everything you need to know about FunPoints, as that system remains in place until 31st May 2026. But where relevant, I’ve also included notes on how things will change under Carnival Rewards.

This guide covers everything you need to know about the current FunPoints system and what’s coming next.

How the Carnival World Mastercard Works

At its core, the Carnival World Mastercard is just like any other credit card. You borrow money for your purchases and pay it off later. But what makes this card stand out for cruise fans is the ability to earn FunPoints with every dollar you spend.

Although it carries the Carnival name, the card itself isn’t issued by the cruise line. Instead, it’s backed by Barclays, one of the world’s largest banks. Carnival sticks to what it does best and leaves the financials to the experts.

You can use the Carnival World Mastercard pretty much anywhere that accepts Mastercard, which means over 37 million locations in more than 210 countries and territories. That makes it easy to rack up points whether you’re grabbing groceries or booking your next Caribbean getaway.

Right now, those points are called FunPoints, and they can be redeemed on purchases with Carnival and even sister brands like Princess Cruises, Costa, and Holland America Line. But from 1st June 2026, things will shift. FunPoints will be phased out and replaced with Carnival Rewards Points as part of the new loyalty programme.

One last thing: this card is only available to US residents aged 18 or over. Even though Barclays has a global presence, this specific product is for the US market.

Thinking of Applying? Here’s the Credit Score You’ll Likely Need

Carnival and Barclays don’t publish an exact credit score requirement for the Carnival World Mastercard, but you’ll generally need Good credit or better to be in with a chance. That typically means a FICO score of at least 670, but even then, approval isn’t guaranteed.

From what applicants have shared, it seems those with scores under 700 often get declined, though there are exceptions. You’ll have a better shot if your credit is rated Very Good (740–799) or Excellent (800+).

Keep in mind, your credit score doesn’t just determine whether you’re approved; it also affects your credit limit and the interest rate (APR) you’ll get. Depending on your credit profile, the APR could be 19.99%, 25.99%, or as high as 29.99%. So, it’s worth checking your credit health before applying.

Perks of the Carnival World Mastercard

So, what do you actually get if you sign up for the Carnival credit card? Here’s a rundown of the current benefits you can expect with the Carnival World Mastercard.

Just a heads-up, these perks are accurate at the time of writing, but they can change. For the most up-to-date terms and conditions, it’s always best to check the official Carnival Mastercard page.

1. 0% APR on Carnival Cruise Bookings (for 6 Months)

One of the standout perks of the Carnival World Mastercard is the chance to spread the cost of your cruise interest-free. When you use the card to book a Carnival cruise, you’ll get a 0% APR for six months. That means no interest, as long as you pay it off in full within that time frame.

After the six months are up, any remaining balance will start collecting interest at your regular rate, either 19.99%, 25.99%, or 29.99%, depending on your credit profile. So it’s essential to plan ahead and clear the balance before the promotional period ends.

This offer could change or be pulled at any time, but if you’re eyeing a last-minute cruise and need a bit of flexibility, this feature can help make it happen, as long as you’re confident you can pay it off in time.

2. Earn Bonus FunPoints Right Out of the Gate

New cardholders can get a generous welcome bonus with the Carnival World Mastercard. If you spend $1,000 within the first 90 days, you’ll earn 30,000 FunPoints. That’s the equivalent of $300 in onboard credit for your next Carnival cruise. Not bad for buying your usual groceries or fuel.

Just be aware this is a promotional offer, and like most things in cruising, it can change. In the past, we’ve seen different versions, like 25,000 points for a $500 spend in 2023, or 20,000 points with no minimum spend in 2024.

If $300 of free onboard spending money sounds good, it might be worth applying while this current offer is live. There’s no guarantee it’ll stick around.

3. Double FunPoints on Carnival (and Sister Brand) Purchases

With the Carnival World Mastercard, every dollar you spend earns you 1 FunPoint. But here’s where it gets good – spend money with Carnival, and you’ll earn double that: 2 FunPoints for every $1.

This doesn’t just apply to booking your cruise, it includes onboard spending too. Link your card to your Sail & Sign account, and every drink, spa treatment, speciality dinner, or gift shop splurge will help rack up those points faster.

And it’s not just Carnival. You’ll also get double points when spending with any of the cruise lines in the World’s Leading Cruise Lines group. That includes Princess, Holland America, Cunard, Costa, Seabourn, P&O Cruises (UK and Australia), and AIDA.

We’re still waiting on confirmation that this benefit will carry over under the new Carnival Rewards system launching in 2026, but so far, it looks like it will.

4. No Annual Fee and No Foreign Transaction Fees

Unlike many travel credit cards, the Carnival World Mastercard doesn’t charge an annual fee, so you won’t pay just to keep the card in your wallet. Even better? There are no foreign transaction fees either.

That means you can use the card abroad (or onboard) without getting stung with extra charges, making it especially cruise-friendly. For a card designed with travellers in mind, this is exactly the kind of perk that makes sense.

5. 0% Intro APR on Balance Transfers (for 15 Months)

When you first open a Carnival World Mastercard, you’ll have the option to transfer balances from your other credit cards and enjoy 0% interest for the first 15 months. Just make sure you complete the transfer within 45 days of opening your account.

This can be a helpful way to consolidate debt or take a breather from high-interest payments, especially if you’re also eyeing the cruise perks. That said, this isn’t a rare offer; many cards have similar deals, sometimes for longer periods.

Also keep in mind: balance transfers aren’t totally free. You’ll pay a fee of either $5 or 5% of the transfer amount (whichever is more), so factor that in when deciding if it’s worth it.

How Carnival FunPoints Work

With the Carnival World Mastercard, you earn FunPoints every time you spend. It’s a straightforward system: 1 FunPoint per $1 on everyday purchases, and 2 FunPoints per $1 when you spend with Carnival or any of its sister cruise lines.

Whether this exact setup will stay the same under the new Carnival Rewards system (coming in June 2026) isn’t confirmed yet, but we’ll keep you posted.

As for redeeming your points, here’s what Carnival says you can use them for:

- Statement credit toward Carnival cruise bookings and onboard purchases

- Redemptions with Carnival’s sister brands

- Carnival-branded merchandise and onboard amenities

- Airline tickets, hotel stays, and car rentals

- Gift cards

However, real-world feedback tells a slightly different story. Many cardholders report that redemption options like merchandise and onboard perks have quietly vanished, so if you were hoping to cash in points for little cruise treats, you may be out of luck.

Also, don’t confuse these with the Group Booking Fun Points Carnival, once offered for organising large groups. Same name, totally different thing.

What Are FunPoints Actually Worth?

FunPoints don’t all carry the same value—it depends how you redeem them. Here’s a breakdown:

Gift Cards: 0.75 cents per point (e.g. 3,300 points = $25 gift card)

Carnival Cruise Purchases ($1,500+): 1.5 cents per point — Best value (100,000 points = $1,500)

Carnival Cruise Purchases ($50–$1,499): 1 cent per point

Sister Cruise Line Purchases: 1 cent per point

Carnival Merchandise & Onboard Amenities: 1 cent per point (availability varies)

Travel Purchases (airfare, hotels, car rentals): 0.9 cents per point

But here’s where it gets a bit strategic.

You’ll get the best value when redeeming FunPoints on purchases of $1,500 or more with Carnival. That’s because the same number of points can sometimes go further depending on how you use them. For example, 100,000 FunPoints could wipe out a $1,000 cruise fare, or a $1,500 one. So if you’re hovering near the $1,500 mark, you might want to upgrade your stateroom and get more bang for your points.

You can also use FunPoints across Carnival’s sister lines, including Princess, Holland America, Cunard, Costa, Seabourn, AIDA, and P&O Cruises UK.

As for Carnival-branded merchandise (when available), the value stays the same: 1 cent per point. Just note that the minimum number of FunPoints you can redeem may vary depending on the item or service.

Can You Use FunPoints for a Free Cruise? Yes—Here’s How

In theory, you can use Carnival FunPoints to score a free cruise, but you’ll need a lot of them. Since 1 FunPoint equals 1 cent, a $1,000 cruise would require 100,000 points. But not all cruises cost that much, so it could take fewer points than you think.

At the time of writing, the cheapest 3-night Carnival cruise I found costs $548 for two people, including taxes and fees. To get that cruise entirely on points, you’d need 54,800 FunPoints.

That said, you don’t have to wait until you’ve racked up enough points to cover the full cruise. You can redeem as few as 5,000 FunPoints ($50) as a statement credit toward your booking. That makes it easier to chip away at your fare, rather than waiting for a giant reward.

To give you an idea of the maths: earning 54,800 points through everyday spending would require $54,800 in purchases. But there’s a shortcut – if you spend $1,000 in your first 90 days, you’ll get 30,000 bonus points. Then, if the rest of your spending is with Carnival (which earns double points), you’d only need to spend $12,400 to earn the remaining 24,800.

How to Redeem Your Carnival FunPoints

Redeeming your FunPoints is easy. Just log in to your online account with Barclays (the bank that issues the Carnival Mastercard), and you’ll find a dedicated section for managing and redeeming your points.

From there, you can browse available options and choose how you want to spend them – whether that’s applying a statement credit toward a cruise, booking travel, or exploring other rewards.

How to Use FunPoints for Statement Credit

Want to use your FunPoints to offset a cruise or travel purchase? Here’s how to redeem them for a statement credit:

- Log in to your Barclays account and head to the FunPoints section.

- Click on “Pay with FunPoints.”

- You’ll see a list of eligible purchases from the past 180 days.

- Find the purchase you want to apply points to and click “Redeem Now.”

- Choose how many FunPoints to apply.

- Confirm your redemption.

That’s it! The credit usually hits your account within 1–2 business days and will appear on your next statement.

Just a reminder, only cruise and travel-related purchases made with your Carnival World Mastercard within the last 180 days are eligible for this type of redemption.

A Few Handy Things to Know About the Carnival Mastercard

1. FunPoints Don’t Expire (Unless You Close the Account)

As long as your Carnival World Mastercard account stays open, your FunPoints will keep piling up until you’re ready to use them. If you do close the account and still have enough points for a reward, you’ll have 60 days to redeem them before they disappear.

When the new Carnival Rewards programme launches in June 2026, your existing FunPoints will convert into Rewards Points, so you won’t lose out.

2. No Built-In Travel Insurance

Unlike some travel credit cards, the Carnival World Mastercard does not include travel insurance. So, if you’re heading off on a cruise, you’ll need to make sure you’ve arranged separate cover.

3. Use Points with Carnival’s Sister Cruise Lines Too

You’re not limited to Carnival. FunPoints can also be used with cruise lines under the Carnival Corporation umbrella, like Princess, Holland America, Cunard, Costa, Seabourn, P&O Cruises UK, AIDA, and even Fathom.

Whether this benefit will continue under the new Carnival Rewards system hasn’t been confirmed yet, but we’ll update you as soon as details are released.

Is the Carnival Credit Card Actually Worth It?

Whether the Carnival World Mastercard is right for you really depends on your personal spending habits and financial situation.

There are certainly other credit cards out there with stronger cashback or travel reward options. And it does take a fair bit of spending to rack up enough FunPoints for significant cruise savings. But if you’re a regular Carnival cruiser and tend to put your everyday purchases on a credit card anyway, this one could be a good fit, especially if you always pay your balance off in full.

Not sold on the card? Carnival offers other loyalty perks too. The VIFP programme (soon to become Carnival Rewards) gives returning guests perks like free laundry, priority boarding, and cabin upgrades. There’s also casino loyalty, which can earn you benefits like free drinks onboard if you spend enough in the casino. And don’t forget Carnival shareholders get a little something too, with onboard credit awarded depending on cruise length.

So, even if the credit card isn’t your style, there are still plenty of ways to cruise smarter with Carnival.

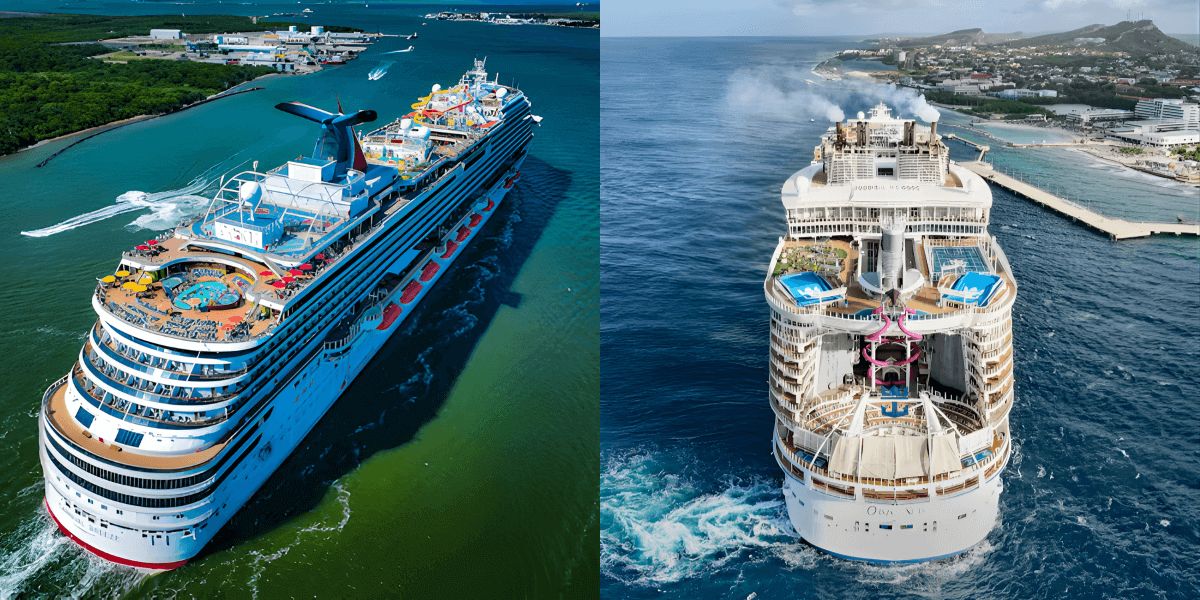

Carnival Cruise Deals

See today’s best deals from ALL travel agents.

You Might Also Like to Read…

Thanks for reading!

I'm Hannah and I've been cruising for as long as I can remember.

If you enjoy my cruise tips, be sure to follow me on social media for more...